The Economics of Employee Turnover: What CFOs Get Wrong

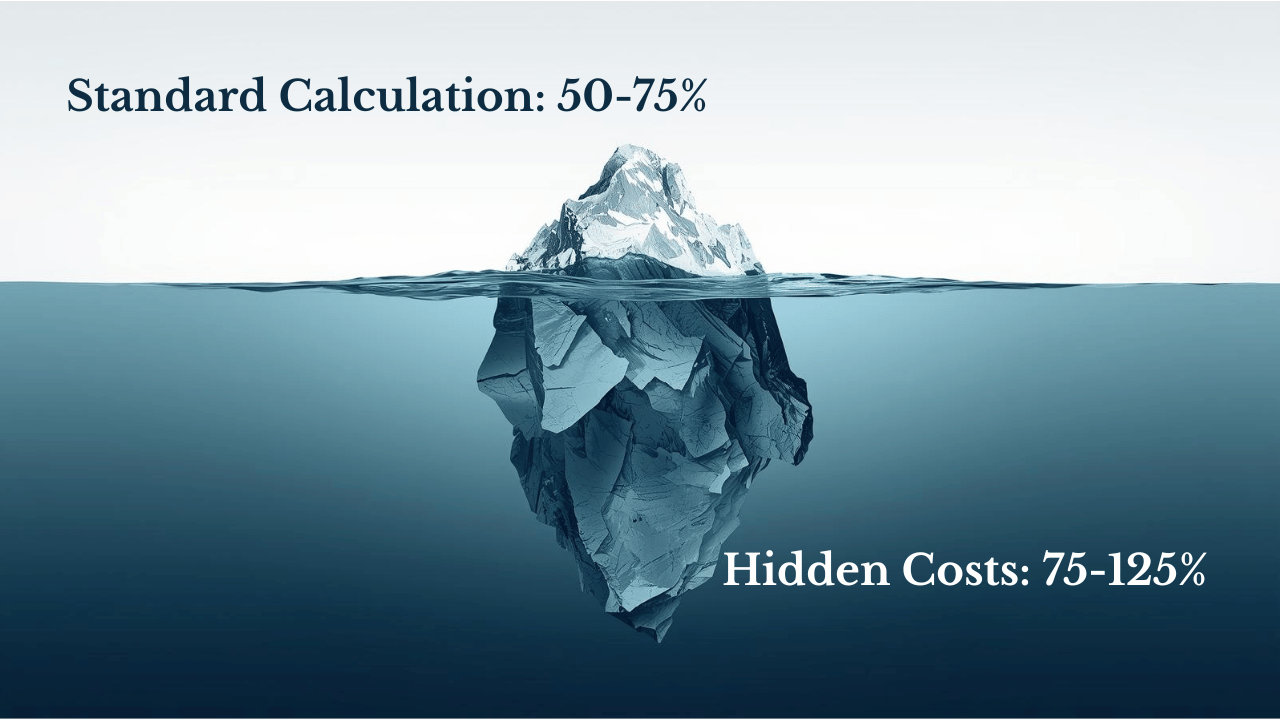

Your finance team calculates employee turnover at 50-75% of annual salary. They're wrong by at least half.

The standard formula (recruiting fees, training costs, onboarding time) captures the visible expenses. It misses the economic damage that unfolds over months, distributed across teams, hidden in productivity reports and project timelines. When a senior developer leaves, your CFO sees $15,000 in recruiting fees and eight weeks of training costs. They don't see the six-month project delay, the institutional knowledge that walked out the door, or the three additional resignations triggered six months later.

This isn't an accounting error. It's a measurement problem. Finance departments are built to track direct costs that appear on invoices and timesheets. They're poorly equipped to measure distributed productivity loss, delayed project outcomes, and the cascading effects that show up quarters after someone leaves. The result: companies systematically underinvest in retention because they systematically underestimate what turnover actually costs.

The Standard Formula and Its Blind Spots

Most organizations calculate turnover costs using some variation of this formula:

Turnover Cost = Recruiting Costs + Training Costs + Lost Productivity

Breaking this down:

Recruiting costs: Agency fees (15-25% of salary), job board postings, recruiter time, interview time

Training costs: Onboarding program costs, manager time during ramp-up, reduced output during learning curve

Lost productivity: The delta between a new hire's output and their predecessor's output, typically measured over 2-3 months

For a $100,000 employee, this formula yields:

Recruiting: $20,000 (agency fee) + $3,000 (internal recruiter time) = $23,000

Training: $5,000 (onboarding) + $8,000 (manager time) = $13,000

Lost productivity: $15,000 (3 months at 50% productivity deficit)

Total: $51,000 (51% of salary)

This matches the 50-75% range CFOs typically use. It's also dramatically incomplete.

The formula assumes:

The position is filled within 30 days

Productivity loss is confined to the new hire's ramp-up period

The departing employee's knowledge is easily transferred

Team productivity remains constant

Customer relationships are unaffected

No additional turnover results from the departure

None of these assumptions hold in practice.

The Hidden Costs Finance Teams Miss

Vacancy Duration and Productivity Loss

The standard formula assumes quick replacement. Reality is slower. The average time-to-fill for professional roles ranges from 36 to 42 days for entry-level positions to 60+ days for senior roles. For specialized technical positions, 90-120 days is common.

During this vacancy:

Work doesn't stop: Projects continue, customer demands persist, deadlines approach

Work gets redistributed: Remaining team members absorb the workload

Everyone's productivity drops: Not just the new hire, the entire team operates below capacity

Consider a five-person engineering team where one developer leaves. The standard formula measures the new hire's reduced output. It doesn't measure:

The four remaining developers each spending 10-15 hours per week covering the vacant role

The team's inability to take on new projects while understaffed

The technical debt accumulated when stretched teams take shortcuts

The delayed feature releases that cost market share

For a senior developer earning $120,000, a 90-day vacancy means:

Vacant role output: $30,000 (3 months × $10,000/month)

Team productivity loss: 4 people × 15 hours/week × 12 weeks × $75/hour = $54,000

Delayed project value: Varies by context, but often exceeds the direct productivity loss

Vacancy cost alone: $84,000 (70% of salary, before any other turnover costs)

Institutional Knowledge Loss

Every employee accumulates context-specific knowledge: which clients are price-sensitive, why that code is structured oddly, which vendor actually delivers on time, how to navigate internal approval processes. This knowledge doesn't appear on any balance sheet. Its absence shows up as inefficiency.

A departed account manager takes with them:

Client relationship history and preferences

Informal agreements and special arrangements

Warning signs that a client is at risk

Which features each client actually uses (versus what they pay for)

The replacement learns these eventually. But "eventually" means:

Three months of suboptimal client interactions

Missed renewal signals that were obvious to the previous account manager

Awkward conversations where the new person doesn't know the relationship history

Quantifying this requires measuring the productivity difference between an experienced employee and their replacement at six-month intervals:

Months 0-3: New hire at 50% of predecessor's effectiveness

Months 4-6: New hire at 70% of predecessor's effectiveness

Months 7-9: New hire at 85% of predecessor's effectiveness

Month 10+: New hire at 95-100% effectiveness (some institutional knowledge never transfers)

For a $100,000 role, this knowledge transfer deficit costs:

Months 0-3: $12,500 (50% productivity gap × $25,000 quarterly salary)

Months 4-6: $7,500 (30% gap × $25,000)

Months 7-9: $3,750 (15% gap × $25,000)

Knowledge transfer cost: $23,750 (24% of salary)

This is conservative. It assumes perfect knowledge transfer of documented processes and systems. Tacit knowledge, the informal understanding of how things actually work, takes longer or never transfers at all.

Team Morale and Productivity Spillovers

When someone leaves, remaining employees ask: "Why did they leave? Should I be looking too? Am I being paid fairly? Is the company unstable?"

This isn't speculation. Research on team dynamics shows measurable productivity declines following departures, particularly when:

The departing employee was well-liked or respected

The departure was unexpected

Multiple people leave in close succession

The team suspects the person left for better compensation

The productivity impact typically follows this pattern:

Weeks 1-2: 10-15% productivity decline as team processes the departure

Weeks 3-8: 5-10% decline as workload redistributes and team adjusts

Weeks 9+: Productivity recovers if replacement is found; continues declining if position stays vacant

For a team of eight people earning an average of $90,000:

Weeks 1-2: 8 people × $1,731/week × 12.5% decline × 2 weeks = $3,462

Weeks 3-8: 8 people × $1,731/week × 7.5% decline × 6 weeks = $6,231

Team morale cost: $9,693 (11% of departing employee's salary, for just one team)

This compounds. If the departure triggers additional turnover, which research suggests happens in approximately 20-25% of cases within six months, the costs multiply.

Customer Relationship Disruption

For client-facing roles, turnover directly impacts revenue. Customers don't care about your internal staffing challenges. They care that:

Their account manager changed mid-project

The new person doesn't understand their business

Response times increased during the transition

They have to re-explain their needs and preferences

The measurable costs include:

Churn acceleration: Customers whose primary contact leaves are 15-30% more likely to churn within the next renewal cycle

Expansion revenue loss: Relationship-driven upsells drop during account manager transitions

Service delivery delays: Knowledge gaps cause slower response times and problem resolution

For a customer success manager supporting $2M in annual recurring revenue:

Baseline churn rate: 10% annually ($200,000 at risk)

Post-departure churn increase: +5 percentage points

Additional churn: $100,000 in lost revenue

Gross margin at 70%: $70,000 in lost profit

Customer disruption cost: $70,000 (58% of a $120,000 CSM salary)

This varies dramatically by role. A warehouse worker's departure has minimal customer impact. A solutions engineer's departure can delay deal closings and cost six figures in pipeline disruption.

Project Delays and Missed Deadlines

Turnover doesn't happen in a vacuum. Projects are underway, deadlines are approaching, commitments have been made. When a key contributor leaves mid-project:

The project slows (remaining team lacks full context or capacity)

The timeline extends (even with backfill, new person needs ramp time)

The scope narrows (team cuts features to hit deadline)

The project fails (team misses deadline entirely)

The cost depends on the project's value and time-sensitivity:

Scenario 1: Product Feature Delay

Original launch date: Q2

Actual launch date: Q4 (6-month delay due to turnover)

Revenue impact: $500,000 in delayed revenue

Opportunity cost: 6 months of competitive advantage lost

Scenario 2: Client Implementation

Contractual delivery date: 60 days

Actual delivery: 105 days (turnover caused 45-day delay)

Penalty clause: $5,000 per week late

Penalty paid: $30,000

Scenario 3: Regulatory Compliance Project

Deadline: December 31 (regulatory requirement)

Risk: Turnover causes team to miss deadline

Potential fine: $250,000

Probability increase: 20% → Cost expectation: $50,000

These aren't hypothetical. Project delays from turnover are common and expensive. But they rarely appear in turnover cost calculations because the causality is indirect.

Why Finance Teams Systematically Underestimate

The measurement problem has three sources:

1. Delayed Costs

Traditional accounting captures contemporaneous costs: the invoice arrives, the expense is recorded. Turnover costs unfold over months:

Month 1: Recruiting costs (captured)

Month 2-3: Vacancy costs (not captured, distributed across team productivity)

Month 4-9: Knowledge transfer deficit (not captured, appears as new hire underperformance)

Month 6-12: Team morale impact and potential cascading turnover (not captured, appears as separate turnover events)

By the time the full cost materializes, it's no longer attributed to the original departure. Finance sees discrete turnover events, not cascading effects.

2. Distributed Impact

If turnover cost $100,000 and appeared as a single line item, CFOs would notice. Instead, it appears as:

$15,000 in recruiting expenses (obvious)

$8,000 in reduced billable hours across the team (buried in productivity reports)

$12,000 in project delay costs (attributed to "project overruns," not turnover)

$22,000 in lost institutional knowledge (shows up as new hire inefficiency)

$9,000 in team productivity decline (invisible in aggregate metrics)

$34,000 in customer churn acceleration (attributed to "market conditions")

Each line item is small enough to escape scrutiny. The total is material but hidden.

3. Hard to Measure

Finance teams excel at measuring what's concrete and trackable: invoices, headcount, hours worked. Turnover costs are often:

Counterfactual (what would have happened if the person stayed?)

Qualitative (team morale, institutional knowledge)

Probabilistic (increased risk of additional turnover or customer churn)

Context-dependent (costs vary by role, tenure, performance, timing)

Without clean data, finance teams default to conservative estimates. Conservative estimates lead to underinvestment in retention.

The Complete Cost Model

Combining direct and hidden costs:

Total Turnover Cost = Direct Costs + Vacancy Costs + Knowledge Transfer Costs + Team Impact Costs + Customer Impact Costs + Project Delay Costs

For a $100,000 employee (mid-level role, typical scenario):

Direct costs: $51,000 (recruiting, training, ramp-up)

Vacancy costs: $25,000 (2 months vacant, team productivity loss)

Knowledge transfer: $24,000 (9-month learning curve)

Team impact: $10,000 (morale and productivity spillover)

Customer impact: $15,000 (for client-facing roles; $0 for internal roles)

Project delays: $25,000 (varies widely; conservative estimate)

Total: $150,000 (150% of salary)

For senior or specialized roles, costs escalate:

Senior Engineer ($150,000 salary):

Direct costs: $75,000

Vacancy costs: $60,000 (3+ months to fill)

Knowledge transfer: $45,000 (12+ month learning curve for complex systems)

Team impact: $18,000 (larger team disruption)

Customer impact: $20,000 (if client-facing; technical escalations)

Project delays: $80,000 (architectural decisions, critical path work)

Total: $298,000 (199% of salary)

The 150-200% range isn't exaggeration. It's comprehensive accounting.

Industry-Specific Variations

Turnover costs aren't uniform. They vary by:

Role complexity: Higher complexity = higher knowledge transfer costs

Client interaction: More client contact = higher customer disruption costs

Team interdependence: Tighter collaboration = higher team impact costs

Labor market tightness: Harder to fill roles = higher vacancy costs

Institutional knowledge depth: Longer learning curves = higher knowledge transfer costs

When Turnover Costs Are Highest

Technology/Engineering: 150-250% of salary

Deep institutional knowledge (codebases, architecture, technical debt)

Long ramp times (6-12 months to full productivity)

Project delays common (critical path dependencies)

Cascading turnover risk (engineers recruit each other away)

Sales (Relationship-Driven): 200-300% of salary

Direct revenue impact (customer relationships walk out)

Pipeline disruption (deals delay or die during transitions)

Long sales cycles mean knowledge transfer takes 9-12 months

Territory disruption affects entire region

Executive/Leadership: 300-400% of salary

Organizational disruption (strategy changes, team uncertainty)

Cascading turnover (teams follow leaders they trust)

External reputation impact (board, investors, partners notice)

Long replacement cycles (6-12 months not unusual)

When Turnover Costs Are Lowest

High-Volume Transactional Roles: 30-75% of salary

Short ramp times (days to weeks)

Minimal institutional knowledge required

Limited customer relationship depth

No project dependencies

Examples: Call center, retail, food service, warehousing

Seasonal/Temporary Roles: 25-50% of salary

Designed for turnover (built into business model)

Standardized training (minimal customization)

No long-term knowledge accumulation expected

This creates a critical insight: retention strategy should be segmented by role economics, not applied uniformly.

The ROI Framework for Retention Investments

If turnover costs 150% of salary, preventing one departure has clear value. The retention investment becomes profitable when:

Retention Investment < (Probability of Departure × Turnover Cost)

Example calculation for a senior engineer:

Salary: $150,000

Turnover cost: $300,000 (200% estimate)

Current departure probability: 30% annually

Expected turnover cost: $90,000

Retention investments that cost less than $90,000 and reduce departure probability are profitable:

Option 1: $20,000 Retention Bonus

Cost: $20,000

Probability reduction: 15 percentage points (30% → 15%)

Expected benefit: $45,000 (15% × $300,000)

Net ROI: $25,000 ($45,000 benefit - $20,000 cost)

Option 2: Manager Training Program ($5,000/manager)

Cost: $5,000 per manager

Team size: 8 engineers

Probability reduction: 10 percentage points per engineer

Expected benefit: 8 × (10% × $300,000) = $240,000

Net ROI: $235,000

Option 3: Career Development Investment ($10,000/employee)

Cost: $10,000

Probability reduction: 20 percentage points (30% → 10%)

Expected benefit: $60,000 (20% × $300,000)

Net ROI: $50,000

The ROI framework shows why retention investments are profitable even at seemingly high costs. A $20,000 retention bonus looks expensive until you compare it to $300,000 in turnover costs.

When High Turnover Is Optimal

Not all turnover is bad. In some contexts, high turnover is economically rational:

High-Volume, Low-Complexity Roles

Examples: Call centers, retail associates, food service

Economics: Turnover cost (30-50% of salary) < retention investment required

Strategy: Optimize for hiring speed and training efficiency, not retention

Calculation for Call Center Representative ($35,000/year):

Turnover cost: $15,000 (43% of salary)

Retention investment to reduce 80% annual turnover to 40%: $8,000/employee

At 100 employees: $800,000 retention investment to save $600,000 in turnover costs

Verdict: High turnover is cheaper than retention investment

Seasonal/Temporary Roles

Examples: Retail (holiday), agriculture (harvest), hospitality (peak season)

Economics: Expected tenure is 3-6 months by design

Strategy: Accept turnover as business model feature, not bug

Performance Management

Examples: Bottom 10% performers who won't improve

Economics: Retention cost (salary + low productivity) > replacement cost

Strategy: Deliberate turnover improves team quality

Market Timing

Examples: Roles where market rate declined (overpaid employees relative to market)

Economics: Salary overpayment > turnover cost

Strategy: Natural attrition corrects compensation structure

The key distinction: High turnover is optimal when retention costs exceed turnover costs. This is true for low-complexity roles with short ramp times and minimal institutional knowledge. For specialized roles with high replacement costs, retention almost always wins.

What This Means for CFOs

The finance department's job is to allocate capital efficiently. Underestimating turnover costs leads to systematic underinvestment in retention. The corrective actions:

1. Revise Turnover Cost Assumptions Move from 50-75% to 150-200% for professional roles. This isn't pessimism; it's comprehensive accounting. Build role-specific models that capture vacancy duration, knowledge transfer timelines, and team disruption.

2. Track Leading Indicators, Not Lagging Ones By the time someone resigns, you've already lost them. Track: employee engagement (properly measured, not annual surveys), manager effectiveness, peer departure clustering, tenure risk curves (18 months and 3-4 years are inflection points), market salary drift.

3. Segment Retention Strategy by Economics High-cost-of-turnover roles (engineering, sales, leadership) deserve significant retention investment. Low-cost-of-turnover roles (high-volume transactional) don't. One-size-fits-all retention programs waste money on roles where turnover is optimal while underinvesting in roles where retention is critical.

4. Measure Retention ROI Every retention investment should have an expected return calculation: What's the probability this reduces departure? What's the cost if they leave anyway? Is there a higher-ROI alternative? Retention bonuses, manager training, career development, compensation adjustments - treat them as capital allocation decisions with measurable returns.

5. Make Turnover Costs Visible The reason turnover is underestimated is because the costs are hidden in productivity reports, project delays, and customer churn. Create a dashboard that attributes these costs to turnover events. Make the invisible visible.

The Bottom Line

Your CFO thinks turnover costs 50-75% of salary because that's what shows up in recruiting invoices and training budgets. The real cost is 150-200% because the damage is delayed, distributed, and hard to measure. This measurement gap causes systematic underinvestment in retention.

The irony: finance departments pride themselves on rigorous cost analysis. But on turnover, they're using incomplete models that ignore the majority of the economic impact. Fix the measurement, and the investment decisions follow.

Retention isn't an HR nice-to-have. It's a financial lever with returns that exceed most capital investments. The companies that recognize this, and build retention strategies based on complete cost models, gain sustainable competitive advantage. The ones that don't keep hemorrhaging institutional knowledge, customer relationships, and team productivity while their finance teams congratulate themselves on keeping recruiting costs below budget.

Key Takeaways:

Standard turnover formulas (50-75% of salary) capture only direct costs and miss vacancy duration, knowledge transfer, team disruption, customer impact, and project delays

Comprehensive accounting puts turnover costs at 150-200% of salary for professional roles, higher for senior and specialized positions

Finance teams underestimate because costs are delayed (appear months later), distributed (across multiple budget lines), and hard to measure (counterfactual and qualitative)

High turnover is optimal only for low-complexity roles with short ramp times—for specialized roles, retention investment almost always beats replacement

Retention ROI analysis shows that investments costing less than (departure probability × comprehensive turnover cost) are profitable

The solution: revise cost assumptions, segment retention strategy by role economics, track leading indicators, make hidden costs visible, and treat retention as capital allocation with measurable returns