Retention Strategies That Actually Work: An Evidence-Based Framework

Your HR department just launched another employee engagement initiative. There's a culture committee, quarterly pulse surveys, and a new Slack channel for "celebrating wins." The slide deck promises to "transform retention" and "build a winning culture."

Six months later, your attrition rate hasn't budged.

This pattern repeats across organizations: well-intentioned retention programs that consume budget and management attention while producing no measurable improvement in turnover. The problem isn't lack of effort; it's that most retention strategies address symptoms rather than causes, rely on lagging indicators, and treat all employees as interchangeable when retention drivers vary significantly by segment.

Evidence-based retention requires a different approach: identify flight risks before they decide to leave, understand what actually drives retention for different employee types, invest in high-ROI levers, and accept that some attrition is optimal. This means abandoning popular but ineffective practices and focusing resources where they generate measurable returns.

The Retention Theater Problem

Most retention initiatives fall into a category best described as "retention theater", visible activities that signal concern about turnover without addressing its root causes. These programs persist because they're politically safe, easy to implement, and create the appearance of action.

Annual Engagement Surveys

Annual engagement surveys remain the most common retention tool despite being fundamentally lagging indicators. By the time survey results show declining engagement, your best employees have already updated their LinkedIn profiles and taken calls from recruiters. The six-month cycle between survey administration, analysis, and action planning means you're working with stale data about problems that emerged two quarters ago. Worse, employees learn to game these surveys, giving inflated scores to avoid being seen as complainers or deflated scores to signal dissatisfaction without the career risk of direct confrontation.

Generic Retention Bonuses

Generic retention bonuses suffer from the hedonic adaptation problem outlined earlier in this series. The motivational impact of a retention payment decays within 60-90 days as employees adjust to their new compensation baseline. Unless you're prepared to distribute quarterly bonuses indefinitely, you've created a temporary satisfaction spike that doesn't address underlying dissatisfaction. The employees who stay for retention bonuses are often those with limited external options, exactly the inverse of who you want to retain.

Related Article: The Half-Life of Salary Increases: Why Your Retention Bonuses Don't Work

Culture Initiatives

Culture initiatives without enforcement mechanisms produce mission statements and values posters but rarely change behavior. Declaring "we value work-life balance" while rewarding managers who send emails at midnight sends employees a clear signal about actual priorities. Culture isn't built through communications campaigns; it's revealed through which behaviors get promoted, which get tolerated, and which trigger consequences.

Exit Interviews

Exit interviews arrive too late and generate unreliable data. Departing employees have strong incentives to provide diplomatic, socially acceptable reasons for leaving rather than honest assessments that might damage relationships or references. "I'm pursuing a new opportunity for growth" is the professional euphemism for "my manager is incompetent" or "I'm underpaid." The information asymmetry works against you: employees know exit interviews can't change their decision, so they optimize for preserving the relationship rather than providing useful feedback.

The ping pong tables, happy hours, and team-building exercises that dominate retention discussions share a common flaw: they're amenities, not retention drivers. Employees don't leave good jobs because the break room lacks a foosball table. They leave because of manager quality, lack of development opportunities, or compensation below market rate. Perks might influence decisions at the margin when candidates choose between equivalent offers, but they don't prevent departures when core employment value propositions fail.

What Actually Drives Retention

Evidence-based retention strategies focus on factors that research and data demonstrate actually influence employee decisions to stay or leave. These levers require more effort to implement than buying a ping pong table, but they generate measurable returns.

Manager Quality

Manager quality represents the highest-leverage retention investment. Research consistently shows that the relationship with direct managers explains more variance in turnover decisions than any other factor. Employees don't leave companies in the abstract; they leave specific managers who micromanage, provide insufficient development, lack competence, take credit for their work, or create hostile team environments.

The quality inversion problem makes manager-driven attrition particularly damaging: your best employees leave bad managers first because they have the most external options, while lower performers stay because they have fewer alternatives. Over time, bad managers create teams of employees who remain because they can't leave rather than because they want to stay.

Improving manager quality requires measuring it through mechanisms beyond annual surveys. Team retention rates provide a leading indicator; managers whose teams experience higher attrition than peer groups managing similar functions reveal quality problems before they metastasize. Skip-level conversations, when conducted confidentially and with psychological safety, can surface management issues that never appear in filtered feedback. Manager effectiveness metrics should include retention alongside traditional performance measures, creating accountability for team stability.

Removing ineffective managers remains the most difficult but often necessary intervention. Organizations that tolerate bad managers signal that political considerations override team welfare, driving out employees who have options while retaining those who don't.

Related Article: The Manager Quality Paradox: Why Your Best Employees Leave Your Worst Managers

Career Paths

Career development and growth paths matter especially for high performers who measure their progress against internal advancement timelines. Employees who see no path from their current role to positions they aspire to begin exploring external opportunities. This doesn't require promoting everyone; it requires clarity about what skills, performance levels, and timelines lead to advancement, and transparency when current employees don't meet those criteria.

Development means expanding scope and responsibility, not just attending training programs. Employees retention improves when they can point to tangible skill acquisition and increased impact over 12-18 month periods. The absence of growth, doing the same work at the same level with no increased responsibility, triggers voluntary departures even when compensation and manager quality are adequate.

Autonomy

Autonomy and scope expansion provide non-compensation retention levers particularly effective for experienced employees. The ability to make consequential decisions, own outcomes, and operate without micromanagement creates job satisfaction that persists longer than the temporary boost from salary increases. Expanding scope (taking on new projects, leading initiatives, or entering new domains) provides growth without requiring promotion into management roles that may not suit technical specialists.

Autonomy matters more as employees gain experience. Junior employees often value structure and clear direction; senior employees find the same level of oversight constraining. Retention strategies that fail to calibrate autonomy to experience level either overwhelm early-career employees or alienate senior ones.

Stay Interviews

Stay interviews conducted 6-12 months before typical flight risk periods create opportunities to address dissatisfaction before employees actively job search. Unlike exit interviews, stay interviews happen when you can still influence outcomes. The questions differ from engagement surveys: instead of asking employees to rate satisfaction on numeric scales, stay interviews probe specific retention factors: what would make you consider leaving, what keeps you here, what would you change about your role, where do you want to be in two years.

The challenge lies in creating sufficient psychological safety that employees answer honestly rather than diplomatically. Managers conducting stay interviews with their own direct reports face inherent conflicts; employees may hesitate to criticize their manager to their manager. Organizations that take stay interviews seriously often use skip-level leaders or HR business partners to conduct them, with aggregated feedback provided to managers stripped of identifying information.

Market-rate Compensation

Market-rate compensation serves as table stakes rather than a differentiator. Paying at market rate prevents dissatisfaction and attrition; paying significantly above market rarely generates proportional retention improvements due to hedonic adaptation. The optimal compensation strategy focuses budget on maintaining market competitiveness rather than attempting to "buy" retention through premium pay.

Market-rate calculations require actual market research, not salary surveys from three years ago. Compensation that was competitive in 2022 may be 15-20% below market in 2026 if your industry experienced wage inflation while your merit increase budget remained at 3-4%. Employees track market rates through recruiter outreach, peer networks, and job boards; they know when they're underpaid before your annual compensation review surfaces the problem.

Selective Retention Budgets

Selective retention budgets allocated to high performers rather than distributed equally generate higher returns. The business impact of losing a top performer who contributes 2-3x median output exceeds the impact of losing a median performer. Retention budgets should reflect this differential value through targeted investments in development, scope expansion, and strategic compensation adjustments for high performers while accepting higher attrition among lower performers.

This creates uncomfortable conversations about employee segmentation and differential investment, but it reflects economic reality. Spreading retention budget evenly across all employees means insufficient investment in your most valuable contributors and excessive investment in your least valuable.

Peer Quality

Peer quality influences retention through the caliber of colleagues employees work alongside. High performers want to work with other high performers; being surrounded by lower performers creates frustration and eventual attrition. Retention improves when hiring bars remain high and performance management removes persistent low performers.

The peer quality factor explains why retention problems often cluster and cascade. When your best employee leaves, peer departures frequently follow as other high performers reassess whether the team still provides the collaboration quality they value. Conversely, removing a persistent low performer or culture detractor often improves retention among remaining high performers who no longer need to compensate for the weak link.

Segmented Retention Strategies

Treating all employees as having identical retention drivers produces inefficient resource allocation. Different employee segments respond to different retention levers, requiring tailored approaches.

High Performers

High performers measure their trajectory against ambitious internal timelines. They often want expanded scope, increased autonomy, and visibility into paths toward senior roles. Retention strategies should emphasize development, strategic project assignments, and direct access to senior leadership. High performers accept that compensation may not always be premium, but they require continuous growth and impact. Stagnation, working at the same level on similar problems for 18+ months, triggers departures regardless of manager quality or compensation.

Technical Specialists

Technical specialists who prefer deep expertise over management responsibility need retention approaches that don't assume everyone wants to lead teams. Individual contributor tracks that provide compensation and status growth without management responsibility retain technical experts who would be mediocre managers. These employees care most about interesting technical problems, autonomy to solve them, and respect for specialized expertise. Forcing them into management to achieve promotion produces bad managers and eventually departures.

Managers

Managers require leadership development, strategic involvement in decisions, and clear feedback about their effectiveness. Retention improves when managers understand how their role fits into broader organizational strategy and see paths toward increased leadership responsibility. Managers leave when they're excluded from strategic decisions, lack development opportunities, or receive insufficient support for their teams.

Early Career Employees

Early-career employees value mentorship, skill-building, and structured development more than autonomy or strategic involvement. Retention strategies should emphasize learning opportunities, clear skill acquisition paths, and relationships with senior employees who can provide guidance. Early-career attrition often reflects insufficient onboarding, lack of mentorship, or unclear expectations rather than compensation or manager quality issues that drive later-career departures.

Identifying Flight Risks Before Decisions Crystallize

Effective retention requires identifying flight risk before employees mentally commit to leaving, typically 6-9 months before they give notice. By the time an employee engages with recruiters, the decision to explore options has already formed. Interventions at that stage rarely succeed because you're addressing symptoms of dissatisfaction that hardened months earlier.

Leading Indicators

Leading indicators include behavioral changes that precede active job searching. Employees who previously engaged actively in meetings becoming passive observers, declining participation in social events they previously attended, or showing decreased initiative on projects signal potential disengagement. None of these behaviors definitively predict departure, but clusters of behavioral changes warrant manager attention.

LinkedIn profile updates (adding skills, requesting recommendations, changing profile photos) sometimes indicate job search preparation, though this signal has weakened as employees maintain profiles more actively. Calendar blocks for "appointments" during business hours, especially clustered around typical interview times, may reflect interview activity.

Manager feedback provides crucial signal, but only when managers are trained to identify and escalate flight risk indicators. Managers who wait until exit conversations to raise concerns about employee satisfaction have missed the intervention window by months.

Market Timing

Market timing affects flight risk independent of internal satisfaction. When competitors are actively hiring, recruiting outreach increases and employees who might not actively job search receive unsolicited opportunities. Retention risk rises during periods when your industry or function experiences hiring surges, regardless of internal employee satisfaction.

Monitoring market conditions through job board postings, recruiter activity, and peer company hiring announcements provides advance warning of increased flight risk periods. Retention interventions during these periods (proactive conversations with high performers, compensation market checks, development opportunities) can prevent departures that might occur simply because attractive external options appeared.

Tenure Risk Curves

Tenure risk curves show elevated attrition probability at predictable intervals. The 18-month mark represents a common departure point as employees complete initial project cycles, acquire portable skills, and assess whether their role provides continued growth. The 3-4 year mark represents another risk period as employees evaluate whether they've extracted available learning and advancement from their current organization.

Related Article: Career Development and the 18-Month Cliff

These tenure milestones should trigger proactive retention conversations, scope expansion, or development opportunities before employees begin actively job searching.

When to Let Employees Leave

Optimal retention doesn't mean minimizing all attrition; it means retaining employees whose continued employment creates value exceeding replacement cost. Some departures improve organizational effectiveness.

Low Performers

Low performers whose output consistently falls below acceptable standards create more value in departure than retention. The time managers spend coaching, documenting, and managing around low performers exceeds the cost of replacement. Other team members who compensate for low performer output experience frustration and eventually attrition themselves. Retaining low performers signals to high performers that standards are negotiable, degrading overall team quality.

Culture Detractors

Culture detractors who undermine collaboration, create interpersonal conflicts, or resist organizational norms damage team effectiveness beyond their individual contribution. Even technically strong employees who poison team dynamics create net negative value. Their departure often improves retention among remaining employees who no longer tolerate the toxic behavior.

Mentally Checked Out Employees

Employees who've mentally checked out following declined promotions, reorganizations, or other disappointments rarely return to previous engagement levels. Retention efforts directed at employees who've already decided to leave waste resources better deployed elsewhere. Exit conversations should confirm decisions rather than attempting to reverse them through last-minute interventions.

Retention Cost Exceeds Replacement

When retention cost exceeds replacement cost, the economic case for retention collapses. If keeping an employee requires 30% above-market compensation, promoting them beyond their capability level, or tolerating problematic behavior, replacement becomes the better option. This calculation should include full replacement cost (recruiting, onboarding, productivity ramp) but not all retention justifies any price.

Related Article: The True Costs of Recruiting and Bad Hires

A Framework for Retention Investment ROI

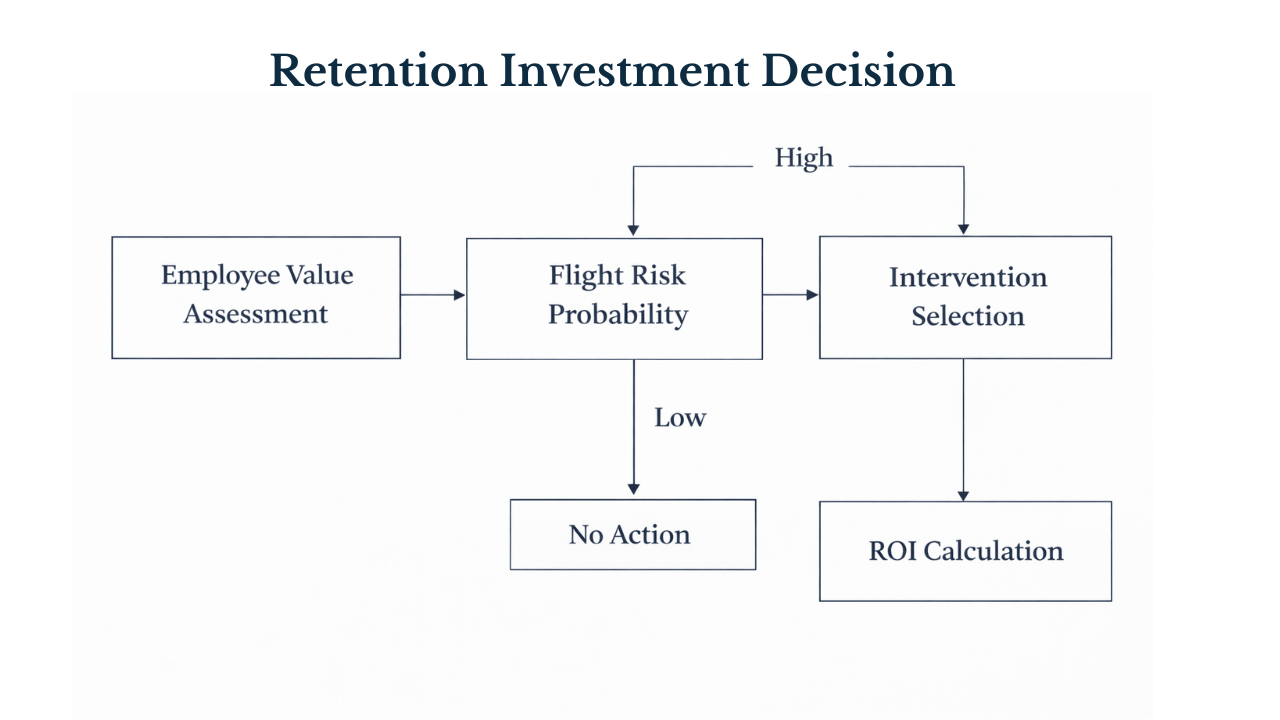

Retention budgets require the same ROI discipline as other capital allocation decisions. The framework for evaluating retention investments:

Calculate True Turnover Cost

Calculate true turnover cost for the specific role or employee, not industry averages. A senior engineer whose departure triggers peer attrition and project delays costs 150-200% of salary. A customer service representative in a role with 4-week onboarding costs 30-50% of salary. Retention investment should scale to actual turnover cost.

Assess Employee Value Beyond Replacement

Assess employee value beyond replacement cost. High performers generating 2-3x median output justify proportionally higher retention investment. Employees with specialized knowledge that takes 12-24 months to rebuild justify higher investment than employees whose skills transfer quickly to new hires.

Estimate Intervention Success

Estimate intervention success probability. Stay conversations with employees showing early flight risk signals have higher success rates than counter-offers to employees who've already accepted external offers. Manager quality improvements affect team retention broadly while targeted retention bonuses affect individual retention narrowly.

Calculate Investment Payback

Calculate investment payback period. If retaining an employee for one additional year through a development program costing $15,000 avoids $120,000 in turnover cost, the ROI is clear. If retaining that same employee requires $40,000 in above-market compensation annually, the economics become questionable.

Monitor Intervention Effectiveness

Monitor retention intervention effectiveness through controlled comparisons. Did teams whose managers received effectiveness training show improved retention versus control groups? Did employees who participated in development programs show better retention than peers who didn't? Retention strategies should produce measurable outcomes, not just activity.

From Retention Theater to Evidence-Based Strategy

The shift from retention theater to evidence-based strategy requires abandoning comfortable but ineffective practices and investing in difficult interventions that generate returns. This means:

Replacing annual engagement surveys with continuous manager-employee conversations and leading indicator monitoring. Stopping generic retention bonuses in favor of selective investments in high performers facing flight risk. Measuring and improving manager quality through team retention metrics and skip-level feedback. Creating development paths that provide growth without requiring everyone to become managers. Accepting that some attrition improves organizational quality rather than attempting to retain everyone.

Most importantly, it means treating retention as a financial decision requiring the same analytical rigor as other capital allocation choices. The question isn't "how do we reduce turnover" but "what level of turnover is optimal given replacement costs, employee value, and retention investment required." Sometimes the answer is to let employees leave.

Evidence-based retention won't eliminate attrition; voluntary turnover reflects labor market dynamics no organization fully controls. But it can ensure retention budget flows to interventions that work, employees worth retaining, and moments when intervention can succeed. That's a substantial improvement over ping pong tables.